Description

The Relative Strength Volume-Adjusted Exponential Moving Average (RS VA EMA) is a technical indicator proposed by Vitali Apirine to help identify trends. Its calculation is similar to that of the original EMA, however, the multiplier used in the formula is adjusted for the relative strength of volume.

The strength of volume is calculated as the difference between positive and negative volume flows. Volume flow is positive when the specified price is higher than the prior price; it is negative when the specified price is lower than the prior price.

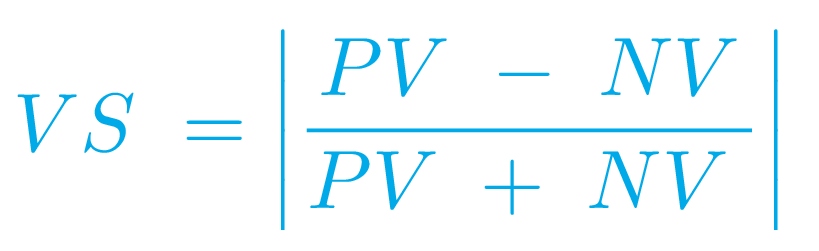

Strength of volume is calculated using the following formula:

where:

PVis the EMA of the positive volume for the specified time period.NVis the EMA of the negative volume for the specified time period.

Relative Strength Volume-Adjusted Exponential Moving Average is calculated using the following formula:

where:

MAis the current RS VA EMA.MA[-1]is the prior RS VA EMA.- α is a multiplier factor equal to

2/ (length + 1). Mltis a user-defined multiplier.

Input Parameters

| Parameter | Description |

|---|---|

price

|

The type of price used in the calculations. |

length

|

The length of the period used to calculate the multiplier factor. |

vs length

|

The length of the period used to calculate the EMA for positive and negative volume flows. |

multiplier

|

The multiplier used in the calculations of the smoothing coefficient. |

Plots

| Plot | Description |

|---|---|

RS_VA_EMA

|

The Relative Strength Volume-Adjusted plot. |

Further Reading

1. “Relative Strength Moving Averages – The Relative Strength Volume-Adjusted Exponential Moving Average” by Vitali Apirine. Technical Analysis of Stocks & Commodities, October 2022.

Example*

*For illustrative purposes only. Not a recommendation of a specific security or investment strategy.

Past performance is no guarantee of future performance.