3 Drive is a Fibonacci pattern. It derives its name from the fact that the price action in it is three consecutive drives to the top (bearish 3 Drive) or to the bottom (bullish 3 Drive).

3 Drive is defined by five points X, A, B, C, and D, of which:

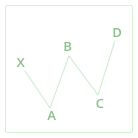

- For a bearish 3 Drive, X, B, D are tops of the price plot, and A and С are bottoms.

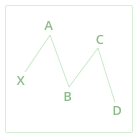

- For a bullish 3 Drive, X, B, and D are bottoms of the price plot, and A and С are tops.

- A drive to the top is followed by the segment XA (first retracement), which is then followed by a second drive AB. This drive is followed by a second retracement BC, then a third drive CD.

- Each of the retracements XA and BC is about 61.8% of the previous drive.

- The distance between С and D is about 127.2% of the distance between B and C.

- A drive to the bottom is followed by the segment XA (first retracement), which is then followed by a second drive AB. This drive is followed by a second retracement BC, then a third drive CD.

- Each of the retracements XA and BC is about 61.8% of the previous drive.

- The distance between С and D is about 127.2% of the distance between B and C.

When the pattern is complete, it may suggest that the price is likely to further find support or resistance at one of the Fibonacci levels calculated based on the price level of point D. Note that the Fibonacci levels are only displayed for the last Fibonacci pattern on the chart.