FAQ - Portfolio Margin

Contacts

Portfolio Margin Learning Center

Portfolio Margin Specialists 877-877-0272 Ext 2

Portfolio Margin

Portfolio Margin (“PM”) is a risk-based methodology used for the computation of risk on eligible stock and option margin requirements for qualifying accounts. PM requirements are based on one day theoretical loss from individual positions instead of the fixed percentages inherent within traditional Regulation T margin requirements.

Portfolio Margin is calculated by using theoretical option pricing models to determine potential real-time losses at various price points for each position. The maximum expected single day loss from these price moves are then aggregated to determine the overall margin requirements for the portfolio.

The PM approach allows an investor to have improved transparency and alignment between margin requirements and the overall risk of the portfolio. This will often result in lower margin requirements than the standard requirements compared to a Regulation T margin account.

Portfolio Margin Price Methodology

As highlighted above, PM is calculated using various price point movements to determine potential real-time losses. Because there are different expected price changes dependent on the characteristics of the underlying positions, the percentage tests will reflect those differences, as following:

- Individual stock and option positions are tested with +/- 15% price changes.

- Large capitalization broad-based indices and Small capitalization broad-based indices are tested with -12%+10% price changes.

- Concentrated positions will be evaluated using a greater percentage price move set by TD Ameritrade due to excess leverage in a single underlying, resulting in a higher requirement than a non-concentrated position.

The total range is then divided into ten equidistant points, and the loss/gain on the position as a whole is calculated at each of the ten points (scenarios). Stress testing is done on a position’s implied volatility and the margin requirement will be the largest loss calculated on any given scenario. Because the largest loss is the margin requirement, a hedged position (defined risk) will have a lower requirement than a position that is unhedged.

Under the Hood of Portfolio Margin

The Firm utilizes a Theoretical Intermarket Margining System (“TIMS”) developed by the Option Clearing Corporation as well as a proprietary model similar to TIMS which uses “two independent volatility calculations”. Sticky Strike and Adjusted Sticky Delta are used to calculate the largest theoretical loss of either curve to determine specific real-time Portfolio Margin requirements.

TD Ameritrade Clearing (“TDAC”) uses two methods to dynamically incorporate IV(implied volatility) into the risk array:

- “Sticky Strike” (Constant IV) Each option strike uses its constant IV in the option pricing model to calculate theoretical option prices at each evaluation point of the risk array

- “Adjusted Sticky Delta” (IV with Slope) The IV is based on the moneyness (e.g. in the money, at the money, out of the money) of an option with respect to the evaluation point. We assign a slope and adjusted volatility to each price point.

Of the two methods used, the risk array yielding the highest theoretical loss is applied for the margin requirement

Product group offsets may be allowed in certain instances where there are high underlying correlations on product groups as determined by the Option Clearing Group (“OCC”), resulting in PM requirement relief.

Portfolio Margin Leverage

As referenced above, position concentrations are evaluated differently based on the different risk profile of these positions. We determine the requirements for concentration as follows:

Proprietary Concentration Logic

An Expected Price Range (“EPR”) represents the Firm’s current best estimate of the price change of a given security over a one-day period. It is expressed in percentage terms of the current security price and is composed of a lower and upper bound*. (e.g. percentage up and percentage down)

*Estimated for each security based on five years of historical price data, if available

TD Ameritrade’s experienced Risk Managers actively monitor EPRs and may adjust where necessary based upon the current market environment. Example factors include, but are not limited to:

- Implied volatility

- Upcoming announcements (Earnings, product release, FDA decision, etc.)

- Point of No Return (“PNR”) for Concentration – The definition of PNR is the percentage move in a security’s price where the account would theoretically lose 100% of its net liquidation value, that is, when the account net liquidation value would be zero.

- Risk Array

- Expected Price Range (EPR) vs. Point of No Return (PNR)

If a PNR is outside or greater than the EPR, then the risk array will default to the house percentages, generally +/-15% for equities and +10%/-12% for equity based indices.

If a PNR is inside or less than the EPR, the higher EPR percentage is used for the array.

Eligible PM Participants

- Full option approval

- Must have $125,000 of net liquidating value and must always maintain $100,000

- Must have advanced features enabled

- Available only to margin (non-IRA) accounts

- Smaller accounts cannot be combined to meet the 125k requirements

- Regulatory portfolio margin minimum of 100k

Portfolio Margin Eligible and Default to Regulation T Margin

Each of the following is subject to FINRA Rule 4210 Margin Requirements and calculated using regular strategy based margin:

- Non-Standard options that result from Corporate actions (spin-offs, splits, etc.)

- Fixed Income

- Exchange traded notes (ETNs)

- Warrants

- Securities deemed ineligible by TD Ameritrade Risk Management

Portfolio Margin Non-Eligible

- OTC (bulletin board) and other non-marginable securities

- Future positions are not permitted to be included in Portfolio Margin for purposes of determining margin requirements of product groups as an offset because of separate jurisdiction between the Securities and Exchange Commission (SEC) and the U.S. Commodity Futures Trading Commission (CFTC)

Portfolio Margin Calls

There are two types of Portfolio Margin calls:

- Portfolio Margin ("P") Call

- Liquidating Value ("L") Call

TD Ameritrade Margin Risk Specialists independently verify the validity of all margin calls and will communicate to the client his/her obligation to meet the margin call.

The client is required to take action within a specific timeframe depending on the category of the margin call. Portfolio Margin calls (P) must be met within Trade Date + 2 days (T+2) and Portfolio Margin Liquidating Value calls (L) must be met within T+10 days. However, TD Ameritrade reserves the right to institute a shorter time frame, including same day, for any call to be satisfied depending on market conditions.

Additional details on the types of Portfolio Margin Calls:

- L Call - Accounts must always maintain a minimum net liquidating value of $100,000. If an account falls below the $100,000 level, a "L Call" will be issued on the next business day and the account is restricted to risk reducing trades only. The customer depending on account equity and market volatility may have until (T+10) to increase the end of day balance above $100,000 to be re-enabled to initiate opening trades.

- P Call – A “P” Call is created when the total margin requirement exceeds the net liquidating value at the end of the business day. The margin call is issued on the next business day and the account is restricted to risk reducing trades on the due date. In this case, the client has until the end of the due date to either close positions or deposit/transfer in funds. Failure to meet the margin call may result in a liquidation.

Portfolio Margin calls greater than 50% equity may be issued as due in T+1, earlier than the standard T+2.

TD Ameritrade reserves the right to issue a Portfolio margin call due immediately based on market volatility ,low equity and large margin call deficiencies.

No opening positions are permitted until a P Call or L Call is satisfied.

PM clients may only trade out of a P Call three times per rolling 12 - month period unless the margin call is due solely to market activity in which case the account may be liquidated without penalty.

TDAC reserves the right to remove PM status from an account at any time. The Margin Risk team will contact the client of any such notification.

Additional Portfolio Margin House Rules

In addition to the margin requirements listed above, TDAC will also utilize the additional following house requirements to protect both the client and TD Ameritrade from additional risk:

• Short Unit Test

1. $1,000 of required account liquidation value per short index option

2. $500 of required account liquidation value per short volatility related products

3. $200 of required account liquidation value per short equity option

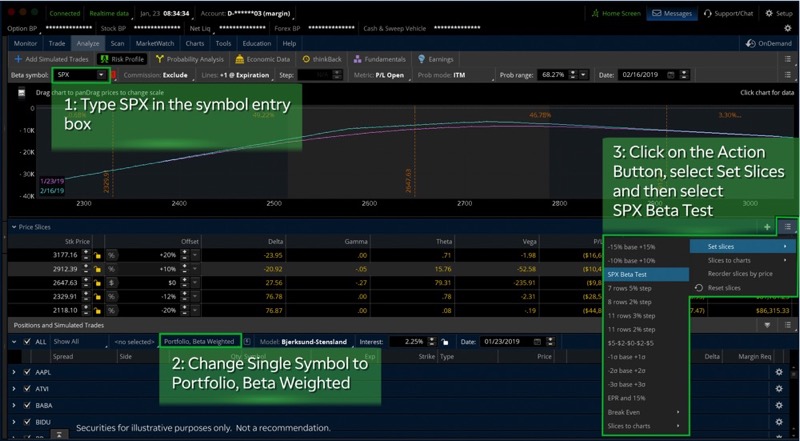

• Beta Test

1. Beta weighting the entire portfolio to the benchmark S & P 500 (SPX) index

2. Evaluate the portfolio beta weighted on a +/- 20% move in the SPX

3. Clients may not incur losses in this scenario of the following:

i. Down 20% move in SPX: cannot have a loss in excess of 2 times the account liquidation value

ii. Up 20% move in the SPX: cannot have a loss in excess of 3 times the account liquidation value

iii. One time net liquidity up 10%

iv. One time net liquidity down 12%

***Please see image below for Analyze Tab setup***

• Vega test

1. Total Vega is reviewed at a level where Total Account Vega cannot exceed more than 12.5% of net liquidated value

2. Far Term Vega (365 days or longer) is reviewed at a level where Vega cannot exceed more than 12.5% of net liquidated value

• Portfolio Margin debit or credit balance vs. net liquidation value ratio

1. Portfolio Margin debit or credit balance vs. net liquidated value ratio cannot exceed more than 15 times

2. If a Portfolio Margin debit or credit balance vs. net liquidated value ratio exceeds more than 20 times, a credit or debit balance reduction is required the day of breach.

PM Low Price and Low Liquidity Eligibility

A security will be excluded for price if:

• A security trades < $2.00 per share for more than five consecutive days

• Additionally, securities will become eligible for PM again if they trade >$3.00 per share for more than five consecutive days

• Securities that trade < $2.00 per share are automatically held at 100% in Reg T accounts and following their exclusion from PM will be held at the Reg T requirement or 100%

A security will be excluded for liquidity if:

• 30-day average volume < 50,000 shares; and

• No instances of average volume > 50,000 shares during the last 10 consecutive days

*These house requirements are subject to change based on market conditions

Real-time Risk Monitoring

The “Analyze” tab within the thinkorswim® platform allows PM clients in real-time to analyze both simulated or existing trades and positions/margin requirements.

The analyze tab on the thinkorswim® platform also provides risk tools for clients to change components such as underlying price, increased/decreased volatility, time to expiration, interest rate, and dividend yield to calculate the theoretical price of the option based on their own market risk scenarios.

Clients may also contact a Portfolio Margin Specialist for any questions regarding their PM account during normal business hours at 877-877-0272 Ext 2

Disclaimer

Portfolio margining involves a great deal more risk than cash accounts and is not suitable for all investors. Minimum qualification requirements apply. Portfolio margining is not available in all account types. Portfolio margining privileges subject to TD Ameritrade review and approval. Not all clients will qualify. Please consider your financial resources, investment objectives, and tolerance for risk to determine if it makes sense for your individual circumstances. Carefully read the Portfolio Margin Risk Statement, Margin Handbook, and Margin Disclosure Document for specific disclosures and more details. You may also contact TD Ameritrade at 800-669-3900 for copies.

It is the client’s obligation to evaluate risks of portfolio margin when making investment decisions. TD Ameritrade reserves the right at its sole discretion to decline a client the use of portfolio margin. In the event TD Ameritrade decides to terminate a client’s use of portfolio margin, the client’s account may be converted to the standard margin account. The conversion of a portfolio margin account to a margin account may require the liquidation of positions.

Portfolio Margin Requirements are calculated intraday using a proprietary risk model which includes underlying price shocks along a risk array. Additionally, for option positions the implied volatility is shocked at each corresponding underlying price move. These theoretical price and volatility shocks used to calculate the portfolio’s margin requirement represent TD Ameritrade Clearing, Inc.’s best estimate of the maximum portfolio risk. The risk model may not account for all potential portfolio risks.